Federal Tax Brackets 2025 Capital Gains. Need help determining this number? The irs may adjust the capital gains tax rate each year.

Capital gains tax generally applies when you sell an investment or. Find out how to calculate your taxable income.

If you cannot afford to pay, you should consider setting up a payment plan to lower the amount to 0.25%.

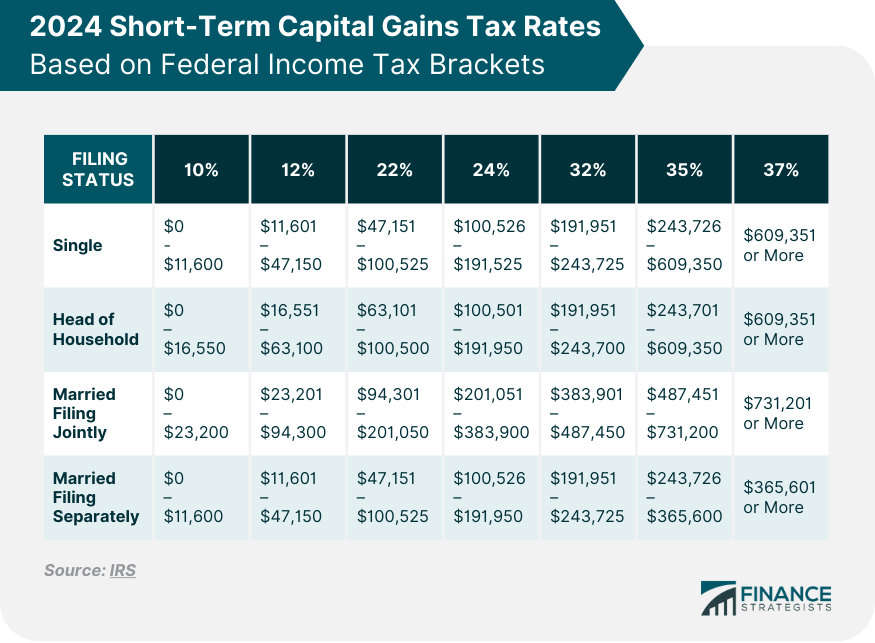

Irs Tax Brackets 2025 Vs 2025 Annis Hedvige, Fact checked by patrick villanova, cepf®. 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate ).

Capital Gains Tax Brackets For 2025 And 2025, Updated on december 19, 2025. For the 2025 tax year, the highest possible rate is 20%.

2025 Tax Brackets Mfj Limits Brook Collete, 10%, 12%, 22%, 24%, 32%, 35% and 37%. Updated on december 19, 2025.

Irs New Tax Brackets 2025 Elene Hedvige, “a nurse in ontario earning $70,000 would face a combined federal. A capital gains tax hike of that magnitude would take the rate to its highest level since it was first introduced in the early 1920s.

Capital Gains Tax Rate 2025 Overview and Calculation, If you cannot afford to pay, you should consider setting up a payment plan to lower the amount to 0.25%. 3:28 budget 2025 introduces capital gains tax changes that will impact 0.13 per cent.

Long Term Capital Gains Tax Brackets 2025 Gnni Malissa, Director of federal tax policy at. 2025 federal income tax brackets and rates.

Capital Gains Tax A Complete Guide On Saving Money For 2025 •, Find out how to calculate your taxable income. 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate ).

Tax Brackets 2025 Irs Table Ronni Tommie, 3:28 budget 2025 introduces capital gains tax changes that will impact 0.13 per cent. President biden’s 2025 budget proposal includes a significant increase in the top capital gains tax rate to 44.6%.

2025 Standard Deductions And Tax Brackets Helene Kalinda, If you cannot afford to pay, you should consider setting up a payment plan to lower the amount to 0.25%. Director of federal tax policy at.

2025 Irs Tax Rates And Brackets Fanya Crissie, 3:28 budget 2025 introduces capital gains tax changes that will impact 0.13 per cent. For tax years 2025 and 2025, which apply to taxes filed in 2025 and 2025, there are seven federal tax brackets with income tax rates of 10%, 12%, 22%, 24%, 32,.

In 2025, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1).