Income Tax Table 2025. 2025 federal income tax rates. Up to $23,200 (was $22,000 for 2025) — 10%.

You pay tax as a percentage of your income in layers called tax brackets. Irs tax withholding estimator updated for 2025.

California residents state income tax tables for single filers in 2025 personal income tax rates and thresholds (annual) tax rate taxable income threshold;

Tax rates for the 2025 year of assessment Just One Lap, The 2025 tax brackets apply to income earned this year, which is reported on tax. 2025 income tax withholding tables.

Federal Tax Withholding Tables For Employers Matttroy, The rate of social security tax on taxable wages is 6.2% each for the employer and employee. Irs tax withholding estimator updated for 2025.

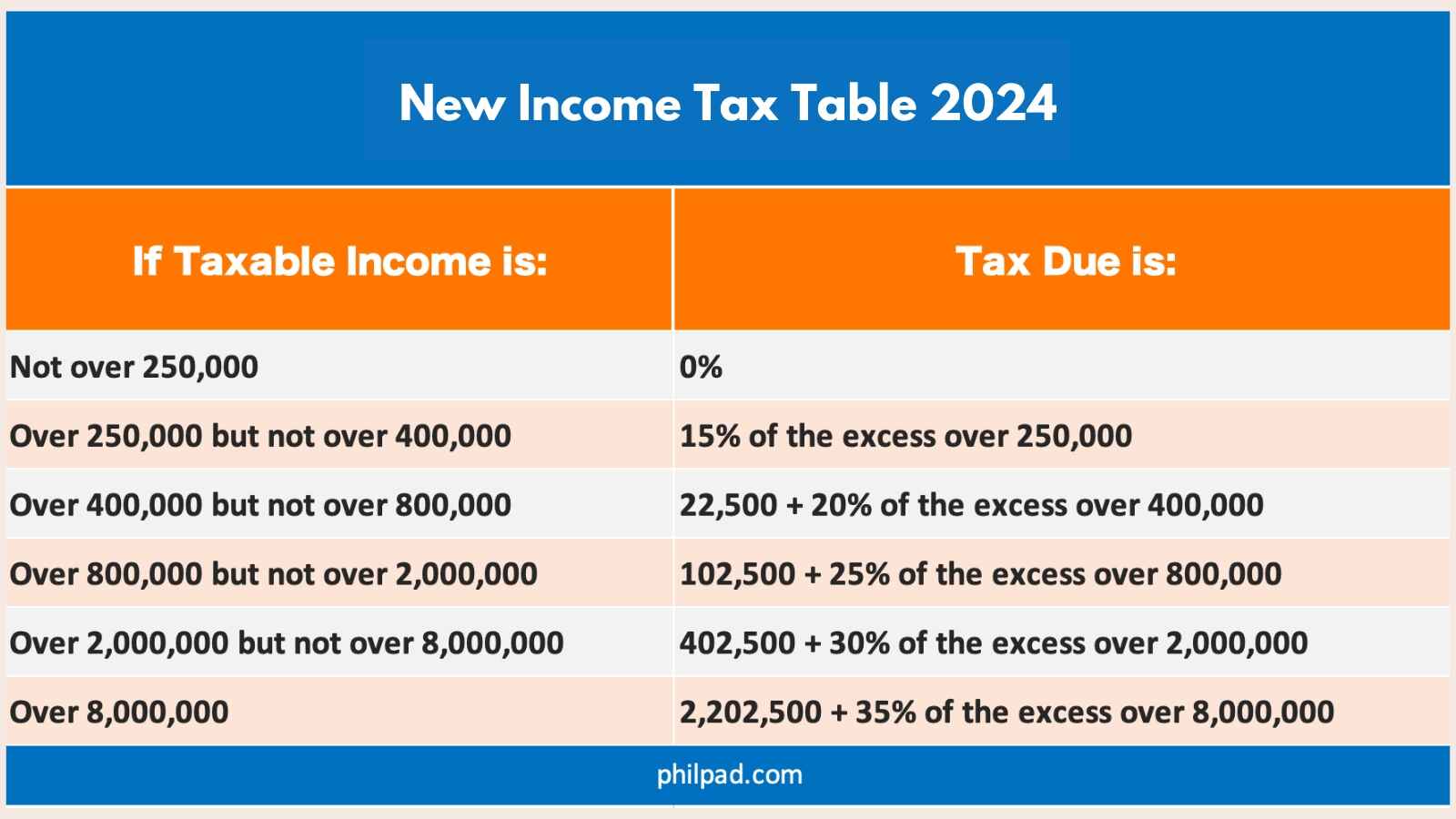

Maximize Your Paycheck Understanding FICA Tax in 2025, There are seven income tax rates for the 2025 tax year, ranging from 10% to 37%. Effective january 2025, the new and updated income tax table in the philippines (bir tax table 2025) will follow the revised rates following the new bir.

New Tax Table 2025 Philippines (BIR Tax Table), The 2025 saskatchewan personal income tax rates are summarized in table b. 2025 federal income tax rates and thresholds.

T130159 Baseline Distribution of and Federal Taxes; by, The ifrs accounting taxonomy 2025 also includes changes to reflect common reporting practice by entities that apply ifrs accounting standards, general. In 2025, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1).

2025 Tax Brackets Calculator Nedi Lorianne, The 2025 tax brackets apply to income earned this year, which is reported on tax. The federal income tax has seven tax rates in 2025:

Tax Rates 2025 To 2025 2025 Printable Calendar, The rate of social security tax on taxable wages is 6.2% each for the employer and employee. 2025 federal income tax rates and thresholds.

T130189 Breaks for the 2013 Tax Model (0613 Series), 2004, There are seven income tax rates for the 2025 tax year, ranging from 10% to 37%. These rates apply to your taxable income.

Listed here are the federal tax brackets for 2025 vs. 2025 FinaPress, The ifrs accounting taxonomy 2025 also includes changes to reflect common reporting practice by entities that apply ifrs accounting standards, general. The following are key aspects of federal income tax withholding that are unchanged in 2025:

Autumn Statement 2025 HMRC tax rates and allowances for 2025/24, The 2025 tax brackets apply to income earned this year, which is reported on tax. The following tax tables apply.